OYO is a hospitality company that operates a network of hotels, homes, and living spaces. An IPO (Initial Public Offering) is when a private company offers its shares to the public for the first time.

OYO filed for an IPO to raise funds, reduce debt, and expand operations. The IPO includes both fresh issue of shares (new shares to raise capital) and offer for sale (existing shareholders selling their stakes).

As of now, OYO has delayed its IPO multiple times, citing market conditions and business restructuring.

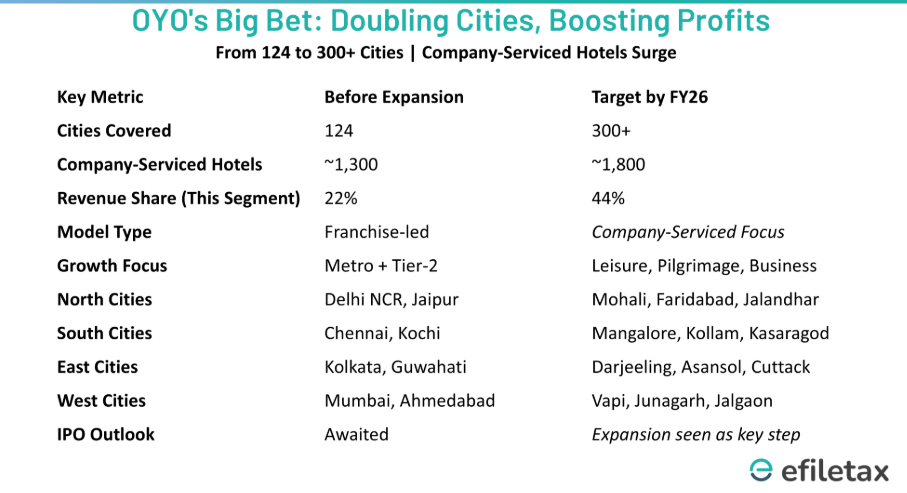

Image Source:- efiletax (X)

Investing in OYO’s upcoming IPO can be appealing, especially for beginner investors, but it’s essential to weigh the potential rewards against the associated risks. Here’s an overview to help you make an informed decision:

✅ Strengths of OYO

- Asset-Light Model: OYO doesn’t own the properties listed on its platform; instead, it operates on a revenue-sharing model, taking a commission of 20–35% from its partners. This approach reduces capital expenditure and operational risks. (businesstoday.in)

- Global Presence: As of March 2021, OYO operated over approx 1.57 lakh storefronts across 34-35 countries, including key markets like India, Europe, Malaysia, and Indonesia.

- Technological Edge: The company boasts a comprehensive technology platform that enhances operational efficiency and customer experience.

⚠️ Risks Analysis:

- Profitability Concerns: OYO has reported net losses every year since its inception, and while it achieved a profit of approx 16 crores in Q2 FY23–24, sustained profitability remains uncertain. (kotaksecurities.com)

- Legal Challenges: The company and its promoters are involved in numerous legal disputes, including some ongoing cases, which could impact its reputation and operations. (inc42.com)

- Debt Load: As of July 2021, OYO had a consolidated debt of ₹4,890 crore, raising concerns about its financial stability. (businesstoday.in)

- Regulatory Scrutiny: The Federation of Hotel and Restaurant Associations of India (FHRAI) has accused OYO of anti-competitive practices, leading to investigations by the Competition Commission of India.

💡 For Beginner Investors

If you’re new Investor in Share Market, then please follow below mentioned points.

- Diversification: Please avoid putting all your funds into a single IPO.

- Long-Term Perspective: Investing in IPOs can be volatile in the short term. Ensure you’re prepared for potential fluctuations in share prices.

- Research: Thoroughly review OYO’s prospectus, financial statements, and any available analyst reports before making decision.

- Feel free to ask any query related to any upcoming IPO. we can suggest you only.